Share the post "Tax Relief or Fowl Play? The Ag Exemption Status of Texas Chickens"

Whether you already have farm animals or dream of them (and live in Texas), you may have heard of Ag exemption and wondered whether you could take advantage of it.

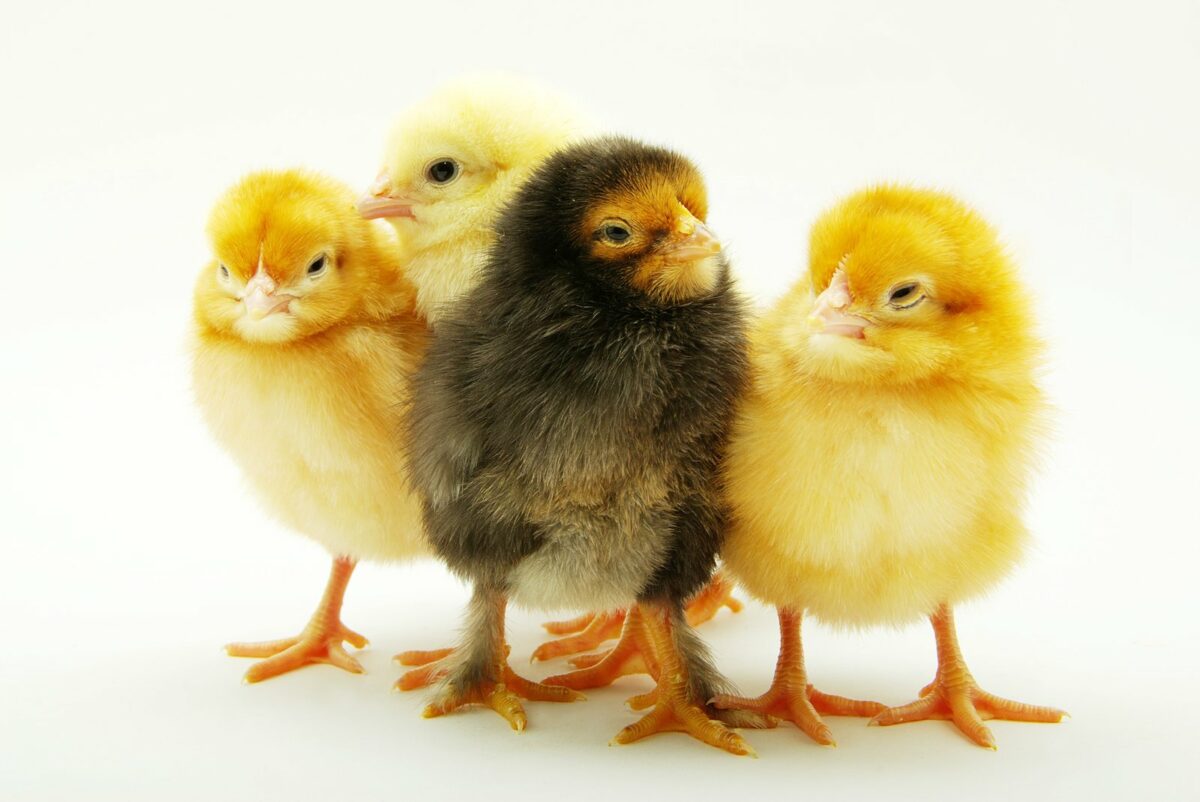

Chickens often qualify for Texas Ag exemption. It isn’t as easy as picking up a few chickens and sticking them in your backyard. You must be eligible as a farmer.

This guide breaks down the specifics of the Texas Ag exemption and how chickens fit into it. We’ll also cover some common questions people have about this topic.

Key Points:

- Texas Ag exemption is a property valuation that reduces property taxes for farmers.

- Chickens can qualify for the exemption if raised for sale.

- Each county in Texas may have different criteria and guidelines for the Ag exemption.

- Consult local Central Appraisal District and tax professionals for accurate information.

- What Is an Ag Exemption?

- Benefits of the Texas Ag exemption

- Do Chickens Qualify for Texas Ag Exemption?

- Steps to apply for the Texas Ag exemption

- Maintaining Eligibility for The Texas Ag Exemption

- Differences in Ag Exemptions Across Texas Counties

- Texas Chickens and Exemption FAQ

- Resources and Assistance for Farmers Seeking the Texas Ag Exemption

What Is an Ag Exemption?

Ag exemptions are sometimes called “farm credits” because they (usually) save on taxes by using your existing agricultural value. The Texas Ag exemption is a type of property valuation where a farmer’s land is appraised based on the capacity of the land to produce goods in agriculture.

Due to the difference between land and production values, farms usually notice decent tax savings by applying for the exemption. The essential part of the exemption is that an authorized appraiser needs to come and evaluate the land.

What Are the Qualifications for Texas Ag Exemption?

Texas exemption guidelines allow these activities to qualify:

- Farming or ranching (only if the purpose is for sale)

- Production of fiber crops, such as cotton or hemp (only if the production purpose is for sale)

- Timber production

- Feedlot operation

- Commercial fish farm operation

- Beekeeping

- Crop dusting

- Custom harvesting

- Growing plants in a commercial nursery for sale

- Veterinary businesses that make farm or ranch calls

- Future Farmers of America (FFA) or 4-H club

- Agricultural vocational courses (teachers only)

Each activity has its qualifications, but if you engage in any of the above professionally, you may qualify for the Texas Ag exemption. You can consult this handout to learn more about qualifying.

Benefits of the Texas Ag exemption

The Agricultural Exemption in Texas, commonly referred to as the “Ag exemption,” provides several key benefits, primarily related to property taxation. It is essential to note that this is not a true exemption from property taxes but rather a special valuation that can substantially reduce the amount of property taxes owed by landowners who qualify. Below are some of the primary benefits of securing an Ag exemption in Texas:

Financial Benefits:

- Reduced Property Taxes: The most significant benefit is the reduction in property taxes. Land that qualifies for the Ag exemption is taxed based on its agricultural production value, which is generally much lower than its market value.

- Potential for Rollback Taxes: While technically a liability, the option for rollback taxes can also benefit when converting the land to a non-agricultural use is advantageous for the owner. Rollback taxes are only applied to the five previous years, allowing for long-term agricultural land to be converted with relatively low tax implications.

Operational Benefits:

- Flexibility in Land Use: Depending on the local Central Appraisal District’s guidelines, owners can engage in various agricultural activities, from farming and ranching to wildlife management.

- Sustainability: The Ag exemption encourages landowners to maintain their land in a way that sustains agricultural production, thereby contributing to local and state agricultural economies.

- Estate Planning and Succession: The reduced tax burden can make it easier to keep land within a family from generation to generation, particularly for families engaged in farming or ranching as a livelihood.

Indirect Benefits:

- Community and Economic Contributions: Encouraging agricultural activities indirectly benefits local economies by supporting local agricultural businesses, from feed stores to equipment dealers.

- Environmental Stewardship: Many agricultural activities, especially those related to wildlife management, may encourage landowners to engage in practices that benefit local ecosystems.

- Cultural and Historical Preservation: Encouraging the ongoing use of land for agriculture can help preserve the rural character and heritage of many areas of Texas.

Precautions:

- Eligibility Criteria: Failure to meet the ongoing criteria for agricultural use can result in the loss of the exemption and the imposition of rollback taxes for up to the previous five years.

- Record-Keeping: Landowners must keep detailed records of their agricultural activities to prove eligibility when applying and sometimes for annual renewals.

- Legal Obligations: Any land-use changes must be reported to the Central Appraisal District, and failure to do so may result in penalties.

- Consult Professionals: Given the financial and legal implications, consulting with tax advisors or legal experts experienced in agricultural exemptions is advisable when applying.

The Ag exemption provides a range of benefits for eligible landowners in Texas, making it an attractive option for those engaged in qualifying agricultural activities.

Do Chickens Qualify for Texas Ag Exemption?

If you hope to pick up a few egg-laying chickens and keep them in your backyard, you may face disappointment in learning that the exemption does not cover that situation. The exemption protects many animals, but there are specific guidelines for these animals to qualify.

You must first qualify for the Texas Ag exemption as a farmer. These qualifications are:

- Having agricultural land of ten acres or more (depending on the residing county)

- The property was used for agricultural purposes for a minimum of five to seven years

- It has a single animal unit for every five to ten improved pasture land acres OR a single animal unit for every 15 to 25 acres of native land

What does animal unit mean? The Texas code defines it as:

- A 500-pound calf is equal to a single animal unit

- One cow and one calf are equal to a single animal unit

- One bull is equal to 1.5 animal units

- One horse is equal to a single animal unit

- One sheep or a goat is equal to a single animal unit

- One miniature horse or a donkey is equal to a single animal unit

Chickens are excluded from the Texas code’s definition of an animal unit. There has been no clear answer to how many chickens are equal to a single animal unit.

The Texas code does include qualifications surrounding chicken use:

- Chickens are raised for sale

- The farmer or rancher must possess an authentic agricultural registration number.

In closing, chickens qualify for an exemption, though the authorized appraiser and your selected tax professional cover the specifics.

Steps to apply for the Texas Ag exemption

In Texas, an agricultural exemption — often called an “Ag exemption” — is not a tax exemption but a special valuation that can result in a lower property tax bill for landowners who use their property for farming, ranching, or other agricultural activities.

The process for applying for an agricultural exemption is handled by your local Central Appraisal District (CAD). Below are the general steps to apply for an Ag exemption in Texas:

Steps to Apply for Texas Ag Exemption:

- Verify Eligibility: Ensure that your property meets the criteria for agricultural use as defined by your local CAD. The land must be primarily used for agricultural purposes like farming, grazing, or wildlife management.

- Download or Obtain Form: Obtain the necessary application form, usually titled “Application for 1-d-1 (Open-Space) Agricultural Use Appraisal,” from your local CAD’s website or office.

- Complete the Application: Fill out the form, providing details about the agricultural activities being conducted on the land. You may need to include supporting documentation, such as leases or evidence of agricultural production.

- Submit the Application: Submit the completed application to your local CAD by the deadline. The deadline is usually on or before May 1 of the tax year, but it’s best to confirm with your local CAD.

- Pay Any Fees: Some districts may require a nominal filing fee. Check with your local CAD about whether a fee applies.

- On-site Inspection: Be prepared for a site visit or inspection by the CAD as part of the review process.

- Receive Notification: You will receive notification of approval or denial. If approved, your property will be assessed at its agricultural value rather than market value, often resulting in lower property taxes.

- Annual Renewal or Re-Application: Some CADs require annual verification of continued agricultural use. Check with your local CAD for the specific requirements in your area.

- Change in Use: If the use of the land changes and it no longer qualifies for the agricultural valuation, you will need to notify the CAD, and you may be subject to rollback taxes for up to the previous five years, where the land was appraised at the lower agricultural value.

Key Points:

- Documentation: Keep meticulous records of your agricultural activities, as you may need to provide these in the application process or in future years to prove ongoing eligibility.

- Local Rules: Each CAD may have specific rules or interpretations of what qualifies as agricultural use, so it’s crucial to consult your local CAD for precise guidance.

- Legal Implications: Failure to properly report changes in the use of your property could result in penalties or rollback taxes.

- Consult Professionals: Given the financial and legal implications of applying for an Ag exemption, consider consulting a tax advisor or attorney experienced in this area.

Remember that these steps are a general guide, and the requirements can vary by county. Always check with your local CAD for the most accurate and up-to-date information.

Maintaining Eligibility for The Texas Ag Exemption

Maintaining eligibility for the Agricultural Exemption in Texas—often called the “Ag exemption”—requires ongoing compliance with various criteria and conditions. The specifics can vary by county and are subject to the rules established by the local Central Appraisal District (CAD).

Below are general guidelines and best practices for maintaining eligibility for this special property valuation:

Best Practices for Maintaining Eligibility:

- Continuous Agricultural Use: One of the most fundamental criteria is that the land must be used primarily for agriculture. This could include farming, ranching, or wildlife management, among other uses. The key is that the use must be continuous and not sporadic or solely for recreational purposes.

- Record-Keeping: Maintain detailed records of all agricultural activities conducted on the land, including purchases related to those activities (e.g., seeds, fertilizers, equipment), any income generated, and any lease agreements if the land is leased for agricultural use.

- Periodic Reporting: Some CADs require periodic reporting or renewals to confirm ongoing eligibility. Check with your local CAD to see if you need to submit any annual or periodic documentation or applications to maintain your Ag exemption status.

- Site Inspections: Be prepared for possible site inspections by the CAD. These inspections are conducted to confirm that the land is still being used for qualifying agricultural purposes.

- Adhere to Local Guidelines: Each local CAD may have specific rules, procedures, or definitions of eligible agricultural use. Make sure to adhere to these local guidelines to maintain your exemption.

Common Pitfalls to Avoid:

- Change in Land Use: If the land is converted to a use that does not qualify for agricultural valuation, you must notify the CAD within a certain period (usually within 30 days). Failure to do so can result in penalties and rollback of taxes.

- Failure to Report Ownership Changes: Any change in ownership generally requires a new application for the Ag exemption. Make sure to reapply when the land changes hands, even if it remains within the family.

- Insufficient Activity: Simply owning land that could be used for agriculture does not qualify you for the exemption. There must be an active agricultural operation on the land that meets the criteria set by your local CAD.

- Not Meeting Acreage Requirements: Some CADs require a minimum acreage for certain agricultural use types. Make sure your property meets these requirements if they exist.

- Non-Compliance with Local Rules: Each CAD might have unique conditions or criteria, such as specific practices for wildlife management or soil conservation. Failure to comply with these can jeopardize your exemption status.

Consult Professionals:

Given the financial and legal implications, consider consulting a tax advisor or attorney experienced in agricultural exemptions. They can provide personalized advice tailored to your situation, including maintaining eligibility for the Ag exemption.

Maintaining eligibility for the Ag exemption in Texas involves ongoing diligence and compliance with state guidelines and local CAD rules. Landowners can continue to benefit from reduced property taxation with proper management and adherence to these criteria.

Differences in Ag Exemptions Across Texas Counties

The concept of Agricultural Exemptions (Ag exemptions) in Texas is governed by state law, but the implementation and interpretation of these laws can vary from one Central Appraisal District (CAD) to another.

Each county’s CAD is responsible for determining eligibility and administering the exemption locally, which leads to some differences across Texas counties. Below are some areas where these differences commonly occur:

Eligibility Criteria:

- Minimum Acreage: Some CADs have minimum requirements for different agricultural activities. For example, one county may require at least 20 acres for a grazing exemption, while another might have a different threshold.

- Intensity of Use: The activity level required to maintain an agricultural exemption may vary by county. For example, one CAD may require evidence of more intensive farming activities.

Types of Agricultural Use:

- Specific Activities: While state law broadly defines qualifying agricultural activities, local CADs may have more specific guidelines for activities like beekeeping, aquaculture, or orchards.

- Wildlife Management: Some counties have specific guidelines or requirements for what constitutes a qualifying wildlife management activity. The standards can differ, such as the type of wildlife that must be present or the management practices that must be implemented.

Documentation and Reporting:

- Initial Application: The type of evidence required to support your application might vary. Some counties may require more extensive documentation of agricultural activities than others.

- Periodic Reporting: Some counties may require annual reporting or periodic renewal applications, while others might only require an initial application unless there is a change in land use or ownership.

- Site Visits: The frequency and rigor of site inspections to confirm ongoing agricultural use may vary by county.

Financial Aspects:

- Rollback Taxes: While the rollback tax period is determined by state law, the manner in which these are calculated can differ slightly depending on local practices.

- Fees: Application fees, if any, can vary from one CAD to another.

Other Local Rules:

- Leasing: Some counties have specific rules about leasing land for agricultural purposes and how this impacts eligibility for an Ag exemption.

- Combining Exemptions: Some counties may have specific guidelines on whether and how you can combine agricultural exemptions with other types of exemptions, such as homestead exemptions.

Consult Local CAD:

Given these differences, consulting your local CAD for guidance tailored to your specific county is crucial. Each CAD will have detailed guidelines, application forms, and often FAQs or informational brochures that outline the specific rules for that county.

In summary, while the overarching framework for agricultural exemptions in Texas is governed by state law, the specific implementation and interpretation of these laws are managed at the county level.

This results in a range of practices and requirements across Texas counties, making it imperative for landowners to consult local resources for the most accurate information.

Texas Chickens and Exemption FAQ

Here are some frequently asked questions regarding chickens and the Texas Ag exemption.

How much savings does the Texas Ag exemption provide?

The exemption rate can save as much as 50% depending on your current tax rate. Whether you are eligible for the exemption and the tax savings you may have access to depends on the county in which you reside.

The best way to learn how much the exemption could save you is to consult a tax professional, one well-versed in the Texas agricultural production tax codes.

Is a barn or coop Ag exempt in Texas?

Under the Texas Sales and Use Tax Code, barns and coops are not exempt from tax. The code states that general-purpose buildings (such as livestock barns, offices, kennels, machine shops, bunkhouses, and hay barns) are not exempt. Barns and coops fall under “livestock barns.”

Is chicken feed tax-exempt in Texas?

Chicken and other animal feed (such as hay, corn, and oats) meant for work animals or animals raised for consumption are exempt from sales tax. This exemption means that chicken feed will not have sales tax applied when paying.

This exemption is in the Texas Administrative Code section outlining the State and Local Sales and Uses Taxes.

Is Ag exemption a type of wildlife exemption in Texas?

Exemption for the AG and the wildlife exemption are two separate exemptions in Texas. Ag exemption is for animals used and raised in an agricultural environment and sold for a profit. To qualify for a wildlife exemption in Texas, you must have acquired an Ag exemption.

To qualify for the wildlife exemption, the farmer or rancher must have a targeted species that they will make and execute a wildlife management plan. In Texas, the species used in the wildlife exemption are often:

- White-tailed deer

- Owls

- Bats

- Songbirds

- Butterflies

Resources and Assistance for Farmers Seeking the Texas Ag Exemption

Local Resources:

- Central Appraisal District (CAD): Most CADs have websites where you can find comprehensive guides and FAQs. You would need to search for your specific county’s CAD website.

- Search Term: “[Your County] Central Appraisal District”

- County Extension Offices: Run by Texas A&M AgriLife Extension, these offices usually have websites with localized advice.

- Local Legal Advisors: Attorneys may have websites or listings where they specialize in agricultural or property tax law.

- Search Term: “[Your County] agricultural law attorney”

State Resources:

- Texas Comptroller of Public Accounts: This office provides state-level guidelines and forms.

- Texas Department of Agriculture (TDA): TDA offers programs that may help farmers meet Ag exemption criteria.

- Texas A&M AgriLife Extension Service: This service provides resources on farming practices.

Online Resources:

- Texas Farm Bureau: This organization provides various resources, including guidelines on Ag exemptions.

- Websites and Forums: Search for specific agricultural websites or forums for advice.

- Social Media Groups: There are local and state agricultural groups where farmers share advice.

- Search on platforms like Facebook for “Texas agricultural groups.”

Financial and Technical Assistance:

- Grants and Subsidies: Look for state and federal grants that may help you qualify for an Ag exemption.

- Financial Advisors: Search for advisors specializing in agricultural finance.

Share the post "Tax Relief or Fowl Play? The Ag Exemption Status of Texas Chickens"

Christian Linden is a seasoned writer and contributor at Texas View, specializing in topics that resonate with the Texan community. With over a decade of experience in journalism, Christian brings a wealth of knowledge in local politics, culture, and lifestyle. He holds a Bachelor's degree in Communications from the University of Texas. When he's not writing, Christian enjoys spending weekends traveling across Texas with his family, exploring everything from bustling cities to serene landscapes.